Bitcoin has been on a free-fall lately, with prices diving down to $20,000. But as any good investor knows, what goes up must come down. So what should you do if you’re holding bitcoin and the price starts to drop? This blog article will give you some predictions and advice on what to do next.

Bitcoin falls below $20,000

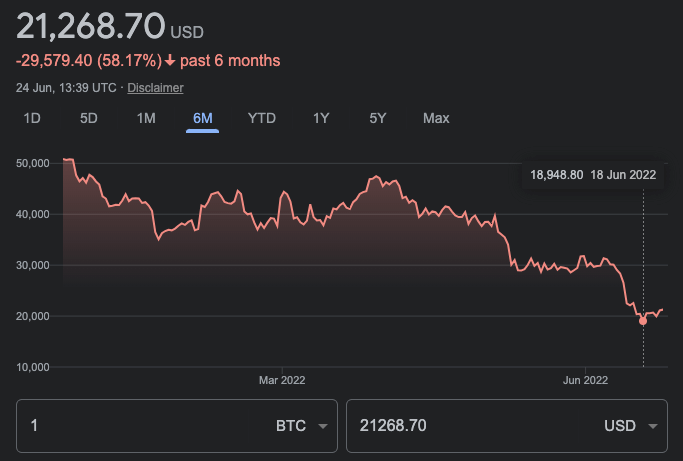

Bitcoin has been on a roller coaster ride over the past few weeks, and the latest dip has seen the value of the cryptocurrency fall below $20,000. This is a far cry from the highs of over $40,000 that we saw in December 2021.

So, what should you do if you’re holding Bitcoin?

First of all, don’t panic! The dip could simply be a blip on the radar and the value could rebound just as quickly. However, it’s always wise to have a plan B in case the worst does happen.

If you’re holding Bitcoin as an investment, then you may want to consider selling some of your coins to cash in on your profits. Alternatively, you could hold onto your Bitcoin and hope that the value increases again in the future.

If you’re using Bitcoin as a currency, then you may need to start looking at alternative options such as Ethereum or Litecoin. These cryptocurrencies are less volatile than Bitcoin and may be more suitable for everyday transactions.

No matter what your situation is, it’s important to stay up-to-date with the latest news and developments in the world of cryptocurrency.

What does this mean for cryptocurrency?

As Bitcoin falls deep, many people are wondering what this means for the cryptocurrency industry. Some believe that this is the end of Bitcoin, while others believe that this is just a temporary setback. However, no one can predict the future of Bitcoin with certainty.

What we do know is that the cryptocurrency industry is volatile and ever-changing. This means that there will always be ups and downs, and it’s impossible to predict what will happen next. So, if you’re thinking about investing in cryptocurrency, it’s important to be prepared for both the good and the bad.

Investing in cryptocurrency is a risky proposition, but it can also be very rewarding. If you’re careful and do your research, you could make a lot of money from investing in Bitcoin or other cryptocurrencies.

HashWorks CEO, Tedd Esse believes that current prices represent an investment opportunity as current prices likely don’t reflect profitable mining margins as the industry is currently structured.

In other words, you should understand that if you’re not careful, you could also lose everything you put in. So remember to always invest wisely and never risk more than you can afford to lose.

How to predict the future of Bitcoin

Bitcoin has been on a roller coaster ride over the past few years. The price of Bitcoin reached an all-time high on November 8, 2021 at $67,582.60, only to crash down to less than 30% of that value on June 18, 2022 (at $18,948.80). As of writing, the price of Bitcoin is once again on the rise. So, what does the future hold for Bitcoin?

There are a few things to take into account when trying to predict the future of Bitcoin. First, we must look at the overall trends in the cryptocurrency market. Second, we must look at the history of Bitcoin and how it has responded to various events. And finally, we must look at the current situation and try to predict what could happen next.

There are a few things to take into account when trying to predict the future of Bitcoin. First, we must look at the overall trends in the cryptocurrency market. Second, we must look at the history of Bitcoin and how it has responded to various events. And finally, we must look at the current situation and try to predict what could happen next.

The cryptocurrency market is notoriously volatile. Prices can swing up or down by hundreds of percent in a matter of days or even hours. This makes predicting the future price of Bitcoin very difficult. However, there are some general trends that we can observe.

As of when filing this post, Bitcoin volume indicators show no buying power in the market.

The total absence of buying power could be a worrying sign for investors who bet on the upcoming reversal following Bitcoin’s return above $20,000, but there is no source of inflows left on the market because of massive liquidation volume and margin calls that institutions received during BTC’s plunge from $30,000 to $17,000.

One trend is that interest in Bitcoin seems to be increasing. Google searches for “Bitcoin” are at an all-time high and there are more people than ever buying and selling Bitcoin on exchanges. This suggests that more people are interested in Bitcoin than ever before and that demand is likely to continue

What to do with your bitcoins if you’re holding them

If you’re holding bitcoins and the price falls deep, don’t panic! Here’s what you can do to weather the storm.

- HODL

This is the most popular advice for bitcoin holders in a bear market. HODL stands for “hold on for dear life” and it basically means to hold onto your bitcoins even when the price is falling. The logic behind this is that eventually the price will rebound and you’ll be able to sell for a profit.

- Use dollar-cost averaging

Dollar-cost averaging is a technique that can help you ride out a bear market. Basically, you invest a fixed amount of money into bitcoin at regular intervals (e.g. monthly or weekly). This way, you average out the price of bitcoin over time and don’t have all your eggs in one basket.

- Take profits when you can

If you’re lucky enough to have made some profits during the bull run, take some money off the table! You can always buy back in at a lower price if you think the market will rebound. There’s no shame in taking profits – remember, it’s just business!

- Stay informed

Bitcoin predictions for the future

From recent development, it appears that Bitcoin is on the rebound. So, what does the future hold for Bitcoin? Here are some predictions for the future of Bitcoin.

- institutional investors will continue to buy up Bitcoin

-

The price of Bitcoin will continue to rise

-

Bitcoin will become more widely accepted as a form of payment

-

More businesses will start accepting Bitcoin as payment

-

Governments will start recognizing Bitcoin as a legitimate currency

How to protect your bitcoins

As the value of Bitcoin falls deep, there are a few things you can do to protect your investment. First, don’t panic sell. Second, don’t listen to the FUD (fear, uncertainty, and doubt). Third, buy the dip.

If you follow these three simple rules, you’ll be in good shape to weather the storm and come out ahead in the long run. So, hodl on tight and don’t let the current market conditions get you down.

Conclusion

There’s no need to panic as bitcoin falls deep. Here are some things you can do to take advantage of the situation and make some predictions for the future. With a little bit of knowledge and effort, you can weather this storm and come out ahead. Thanks for reading!

Comments are closed.