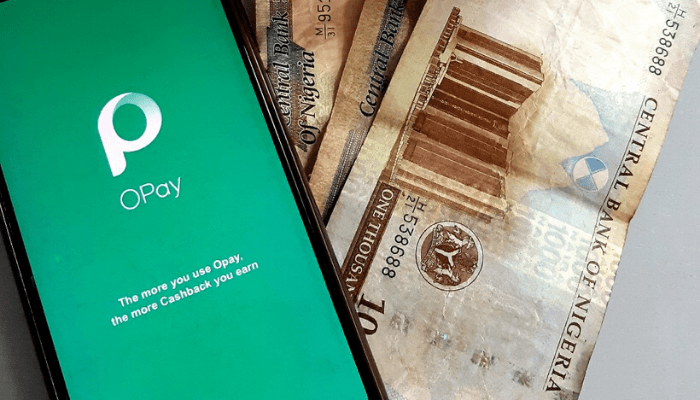

2024 IFIC honors OPay for advancing financial inclusion in Nigeria

Leading Nigerian financial services provider OPay has been honored with the prestigious International Financial Inclusion Conference (IFIC) Award for Financial Inclusion Innovation by the Central Bank of Nigeria (CBN).

The recognition was announced at the 2024 IFIC, a high-profile event that brought together global regulators, industry leaders, and experts to discuss strategies for enhancing financial inclusion across Africa.

This award underscores OPay’s alignment with regulatory standards and its contribution to Nigeria’s goal of achieving a 95% financial inclusion rate. By working closely with the CBN and other regulatory bodies, OPay has expanded access to digital financial services for millions of Nigerians, overcoming long-standing barriers to inclusion.

The selection process evaluated critical metrics, including adherence to regulations, technological advancements, customer impact, and contributions to the CBN’s financial inclusion objectives. OPay emerged as the winner for its secure, innovative, and accessible financial solutions, outperforming other key players in the financial sector.

OPay CEO Dauda Gotring expressed pride in the achievement, saying, “This recognition by the CBN highlights OPay’s dedication to providing innovative, compliant, and inclusive financial solutions.”

The IFIC also addressed challenges in Nigeria’s financial inclusion journey, including expanding service access, boosting digital literacy, and fostering partnerships between regulators and private enterprises like OPay.

OPay, founded in 2018, has established itself as a pioneer in delivering inclusive financial services using technology. Its offerings include money transfers, bill payments, airtime and data purchases, card services, and merchant payments. Known for its reliability and speed, OPay operates under a CBN license and is insured by the NDIC, ensuring the same level of safety as commercial banks.

Comments are closed.